Art Investment Platform Masterworks Is Now Valued at $1 Billion

- October 07, 2021 14:36

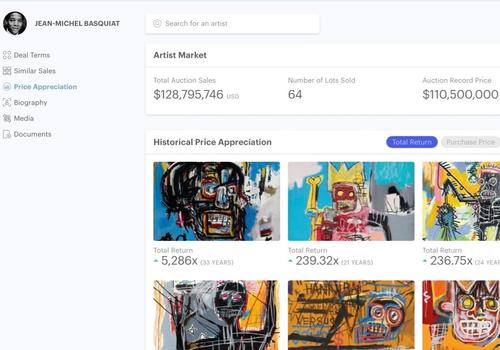

Masterworks.io, a pioneering startup offering fractional investment in fine art, raised $110 million in Series A funding at a pre-money valuation north of $1 billion this week.

The New York City-based platform reached unicorn valuation following funding from Left Lane Capital, with participation from Galaxy Interactive and Tru Arrow Partners, among others.

Contemporary artists from Warhol and Basquiat to Kusama and KAWS are among the blue-chip stable that Masterworks invests in.

“We really believe that the only investable segment of the art market are paintings [worth] a million dollars or more, generally speaking, and when I say investable, I mean something that produces predictable returns,” CEO Scott Lynn told TechCrunch.

The average investor puts in about $5,000 per painting, with Materworks holding the investmest for about 3-10 years before selling the work for a profit on the secondary market, then passing the pay out to shareholders.

Masterworks earns 20% of the profit each time a painting sells alongside a 1.5% per year management fee on each piece of artwork, according to TechCrunch. So far, the platform has purchased $200 million in paintings.

According to Artprice, blue-chip art has outperformed the S&P 500 by 180% from 2000–2018.